Learn about Does SoFi Use Zelle. Discover whether SoFi, a leading financial technology company, utilizes Zelle for its money transfer services.

Introduction

Digital banking is one of the significant ways we handle our money nowadays. A variety of options exist when it comes to these services and deciding on the one to use might not be that easy. Many people usually ask whether Zelle which is an online network for payment is used by Sofi which is a popular financial technology company since it is so commonly used.

What is sofi?

The company is an emerging financial services company based in San Francisco. The company started in 2011 to help students refinance their loans. In addition, it has expanded its business by introducing other services like personal loans, mortgage loans, investment accounts, and SoFi Money (a cash management platform).

SoFi seeks to provide young and recent professionals with an all-encompassing financial solution, using technology to offer competitive rates and user-friendly digital experiences. Besides, community and membership benefits are also given by SoFi about career coaching and financial planning services meant to assist its members in attaining their financial goals.

What is Zelle?

Zelle is a digital payments network that enables fast and easy transactions between American banking customers. Zelle was first released in 2017 and is run by Early Warning Services which is a joint venture of numerous well-known United States-based financial institutions. This app works by incorporating its systems directly into various banks’ online platforms thereby offering convenient services to all its clients.

Sending money using Zelle is easy; all one needs to do is give the receiver the email address he or she has registered under Zelle or their phone number. A lot of times, the transaction is completed in less than 5 minutes, making it one of the fastest peer-to-peer options available. Zelle’s fees per standard transaction are zero therefore; it is a convenient and cheap way to make regular payments like splitting a bill, rent payment, or sending money to a buddy.

Pros of Using SoFi for Money Transfers

Here are the pros of using SoFi for money transfers:

- Integrated Financial Services: SoFi provides an extensive range of financial offerings than money transfer services only. By offering student loans and investment opportunities, the company has positioned itself as being an all-inclusive platform where different financial requirements can be met making it easier for users to deal with their economic issues using a single interface.

- Transparent Fee Structure: SoFi prides itself on having a clear fee structure that lets you know exactly what is going to cost you for every transaction you make. So with hardly any hidden fees, users will be confident they will not face extra charges when they transfer money using SoFi.

- User-Friendly Interface: The creation of the SoFi app is pegged on enhancing the user’s experience since it features an easy interface that helps the users shift money to others as well as handle other financial tasks without complications. At the same time, you may be a knowledgeable person in technological issues or a person using digital banking for the first time; but with SoFi’s platform, it is easy for all people to manage their finances.

- Quick Internal Transfers: SoFi allows for immediate money transfers across SoFi accounts, enabling individuals to send and receive money in seconds. The ability to move money quickly between one’s accounts or with other SoFi users makes this feature especially helpful.

- Community Benefits: The main aspect separating SoFi from other financial institutions is its community-focused strategy when it comes to customer engagement by having activities members can participate in, job opportunities available through this platform as well as information on how to manage their finances better thereby serving as an example on the best practices to observe.

Pros of Using Zelle for Money Transfers

Here are the pros of using Zelle for money transfers:

- Instant Transfers: Zelle’s almost immediate transfer speed is among its biggest pluses. For quite some time, you would realize that the sent cash via Zelle is accessible by the recipient in a matter of minutes which brings about unprecedented convenience especially when the users want money sent or received hastily.

- Wide Acceptance: Zelle connects with most of the biggest American banks and financial providers, hence it is easily obtainable by many users. Since it connects to various banks, one can send money to friends, family, or anyone else they might wish, despite where they hold their accounts.

- User-Friendly Interface: “Zelle provides an easy-to-use interface that enables one to send or receive money without any hassle. This means that one can start transfers using just an email address or phone number instead of relying on complex account numbers or routing codes.”

- No Fees: Users will not be charged extra money to send money or receive money through Zelle in most instances. Unlike other money transfer services that may charge for their services, Zelle does not charge its users for making transactions.

- Security Measures: The security of user transactions is given priority by Zelle because of the utilization in their system of advanced encryption and authentication protocols which ensure the protection of sensitive data. Consequently, there is a high guarantee for any customer that money transfers made through this system are safe and cannot be accessed by any unauthorized persons thus avoiding any fraudulent activities.

Does SoFi Use Zelle?

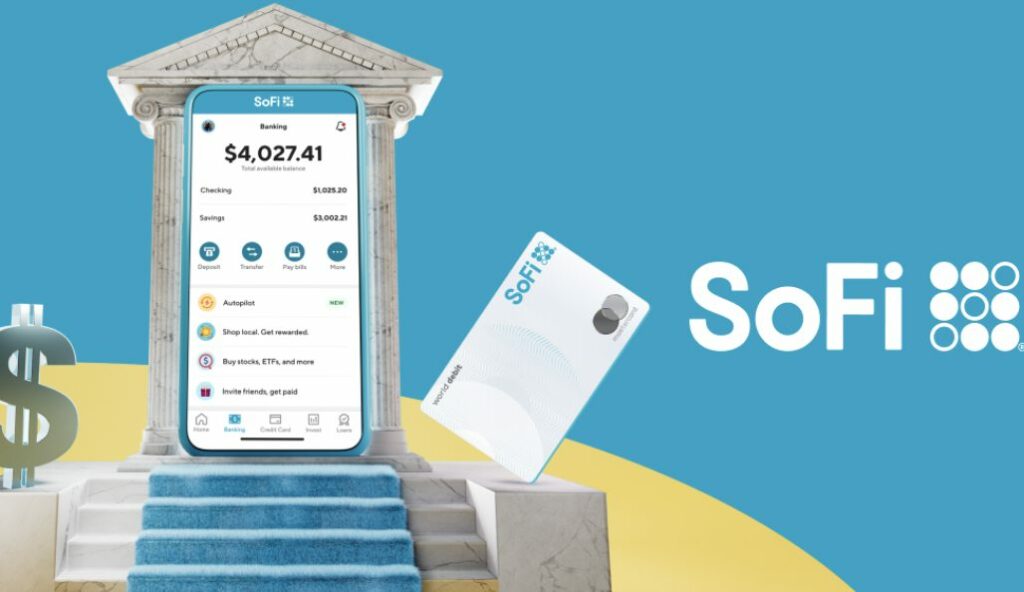

No, SoFi at the moment does not work with Zelle. HTML. The reason for this is that even though Zelle a popular digital payment system, is well known for fast and easy transfers from one US bank account to another, SoFi decided against integrating them into its platform. Rather than that, what SoFi does is provide its cash management tool called SoFi Money enabling easy sending/receiving payments, and bill payments.

SoFi Money is compatible with Zelle in offering quick and safe transactions inside its network. On top of this, SoFi users can make money transactions using other well-known peer-to-peer payment services like Venmo, PayPal, and Cash App.”

“For some users who prefer Zelle’s seamless bank-to-bank transfers, the absence of Zelle may not be a problem. However, SoFi offers various financial products and services to suit different financial requirements.”

Alternatives to Zelle for SoFi Users

1. PayPal

PayPal is a very commonly used online payment platform that is capable of hosting a wide array of personal and business transactions. Account holders at SoFi can connect their PayPal accounts to send or receive any amount of money.

2. Venmo

One of the most popular choices for person-to-person payments is Venmo, which is owned by PayPal. It offers transaction feeds and other social aspects that make it fun and convenient to use for friends’ payments.

3. Cash App

Zelle, an application is a connexion with the Corporation created by Square to provide services similar to that. When making quick shifts, people who use SoFi can integrate easily with the cash app.

FAQs

Currently, there are no confirmed plans for SoFi to pair with Zelle, but financial technology is highly volatile so this may soon change.

Right now, there is no way for you to connect your SoFi account with Zelle, so no one can transfer money between two SoFi accounts unless they’re using the bank’s service.

Yes, users of SoFi can transfer cash from their SoFi account into an outside bank account. One can do this either through the SoFi app or website by linking their outside bank account and then starting their transfer process. But they need to note. Information regarding any required fees or time frames attached to these types.

SoFi isn’t a traditional bank, but instead a financial technology company providing services designed for finance including loans, investments, and banking products via their website or app platform.

Conclusion

Zelle is not yet natively supported on SoFi. But you can still use it on SoFi by linking your account with your bank’s Zelle-supported account. This indirect way can help you tap both platform’s benefits. Sometime in the future, as digital payments improve, there is a likelihood that Zelle will be part and parcel of SoFi.For now, workarounds that are currently available to use as an alternative and payment methods are enabling people’s finances to be managed efficiently.